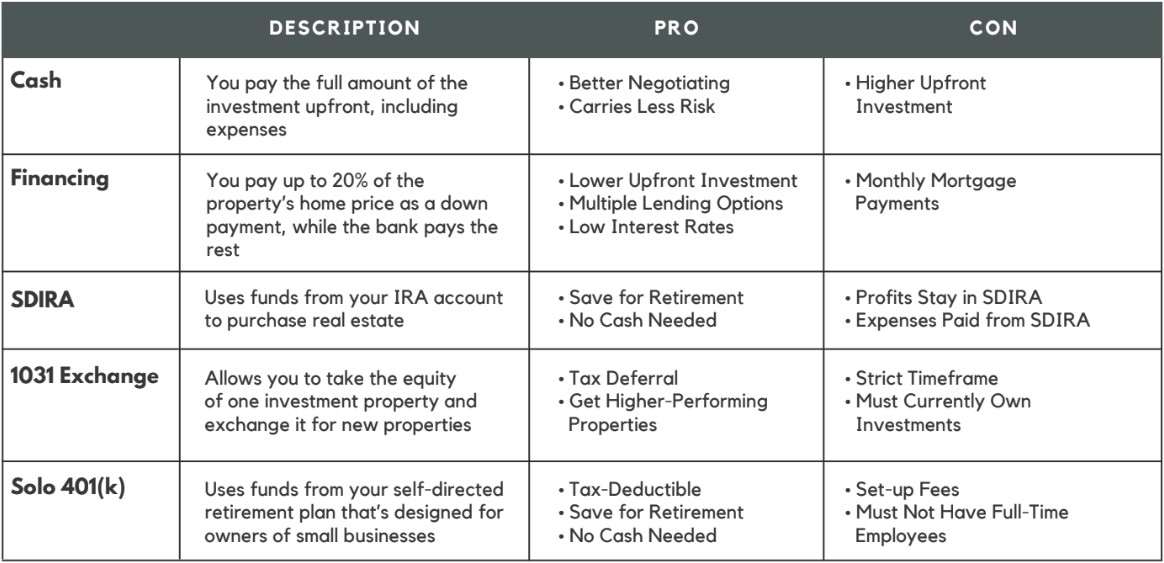

#1 DECIDE ON YOUR SOURCE OF FUNDING

Here are the most common funding options for purchasing an investment home:

2. MAKE AN OFFER

After you’ve chosen your source and means of funding, you will need to attend to all the paperwork and supporting documentation to solidify and secure your funding. This will allow you to place your offer quickly. To make an informed bid on any investment property, use comparable homes sales. The best way to go about uncovering the most accurate information is to partner with a local real estate professional, and have them do the research.

3. INSPECTION AND ANALYSIS

When the seller accepts your bid and the property goes into contract/escrow, you’ll need to make sure that the property is still a sound opportunity for you. Minimizing the possibility of unforeseen issues by conducting an inspection, appraisal, and a home evaluation by a licensed contractor. Partnering with these experts can mean a difference between lucrative returns — and a failed investment.

4. CLOSING

At the closing table, you’ll need to complete all the necessary paperwork to close on the property and receive ownership of its title. Work with your lender to have this completed as quickly as possible. The faster you move, the quicker you’ll start earning your returns.